The supplier is totally integrated with OCX, the Open Foreign Money Exchange. The finest prop agency for day merchants isn’t just the one with the flashiest profit cut up, it’s the one whose rules and execution match your edge under real conditions. Prioritize intraday guidelines, execution quality, and clear prices. Validate with a small test, then scale with discipline. Liquidity suppliers supply the necessary funds to facilitate trades, guaranteeing there might be sufficient liquidity available within the market. They act as intermediaries between consumers and sellers however do not usually hold an inventory of assets.

What Are The Benefits Of Using Liquidity Providers?

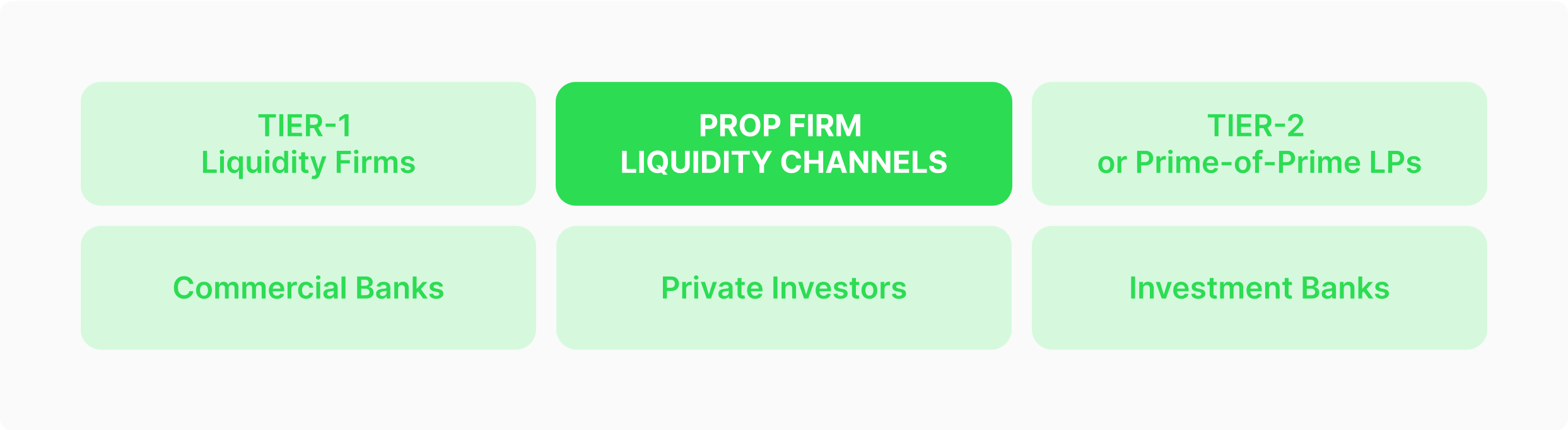

Liquidity providers be certain that the market has tradable forex pairs and provide pricing info. Whereas brokers hyperlink traders to liquidity providers and execute trades on behalf of the merchants. Too many traders have skilled payout failures from financially confused prop companies. As a regulated liquidity provider serving over a hundred and fifty brokers globally, FX-Edge brings nearly a decade of market experience and proven monetary resources. This provides prop corporations absolute certainty that dealer profits will be honored and paid promptly. Through cTrader’s Manager’s API, exposure could be scaled dynamically.

- Instead of committing stay funds immediately, corporations place traders on simulated, or demo, accounts that mirror real market circumstances.

- FTUK is by far the best Prop i’ve labored with in my 10+ years of buying and selling.

- To sum up the symbiotic dance, each get together take their share of the earned fee.

- These providers assist streamline the trading course of, scale back costs, and improve the general trading expertise for market members.

Advanced Markets

Merchants need confidence that execution is fair, while companions and liquidity providers require evidence of strong oversight. Transparent reporting and trade receipts deliver liquidity provider selection for prop trading firms this credibility. These are reserved for elite traders who have proven long-term consistency. They gain entry to live brokerage accounts but remain underneath strict rules similar to day by day loss caps, drawdowns and place dimension limits.

The Forex Broker Turnkey solution includes all the important thing elements required for efficient risk administration in Forex brokerage companies, together with a smart liquidity aggregator. To sum up the symbiotic dance, each https://www.xcritical.com/ get together take their share of the earned fee. On-line brokers charge the trader a commission whereas LPs earn profits when they buy or sell property at profitable prices.

Built For The Model New Generation Of Traders

If drawdown or loss caps are missed, payouts can exceed analysis revenues and destabilise the business mannequin. For this purpose, direct funding must at all times be supported by strict oversight and clear Cryptocurrency wallet execution reporting. Liquidity suppliers also contribute to market stability. They absorb giant trades from institutional investors, or “whales,” to stop sharp price swings that could be dangerous for merchants, especially those utilizing margin. Scope Markets offers brokers with liquidity from market-leading Tier 1 and Tier 2 banks, world liquidity providers, and ECN venues. Saxo Group is a financial institution that gives liquidity providers to handle risks and operate throughout a quantity of monetary devices.

Spreads, liquidity, and execution speed are identical to a stay environment, but no orders reach the market. Advanced Markets is a leading supplier of prime-of-prime liquidity, offering credit and technology solutions to brokers and asset managers worldwide. The firm’s vary of merchandise supports direct market access (STP) trading in a variety of https://neter-x.com/what-crypto-means-to-millennials-and-gen-zs/ monetary devices, including Spot FX, metals, vitality, and CFDs. Automation and artificial intelligence will continue to revolutionize buying and selling.

This allows startups to concentrate on attracting merchants and constructing their brand rather than building infrastructure from scratch. The main revenue stream comes from analysis fees, which cowl operating prices, dealer payouts, and future funding allocations. Since solely a portion of merchants advance beyond evaluations, the mannequin stays balanced.

As soon as the LP is contacted, the LP analyze the order and market situations. If the order can be profitably fulfilled they comply with act as the counterparty, that is to purchase or sell the asset. LPs proactively add orders to the order book, even when there isn’t any quick buyer or seller, this ensures steady market activity and facilitate smoother price discovery. LPs regularly quote bids and ask costs, they act as market makers and set reference factors for different participants.